This is how to handle employee bonus in QuickBooks Payroll. You will first need to add a Bonus type under the employee profile and then you run either just a Bonus check alone or the regular check with the Bonus amount. You will need to take the following steps to process the bonus check:

To set up Bonus as “Additional pay” type to the name of the employee:

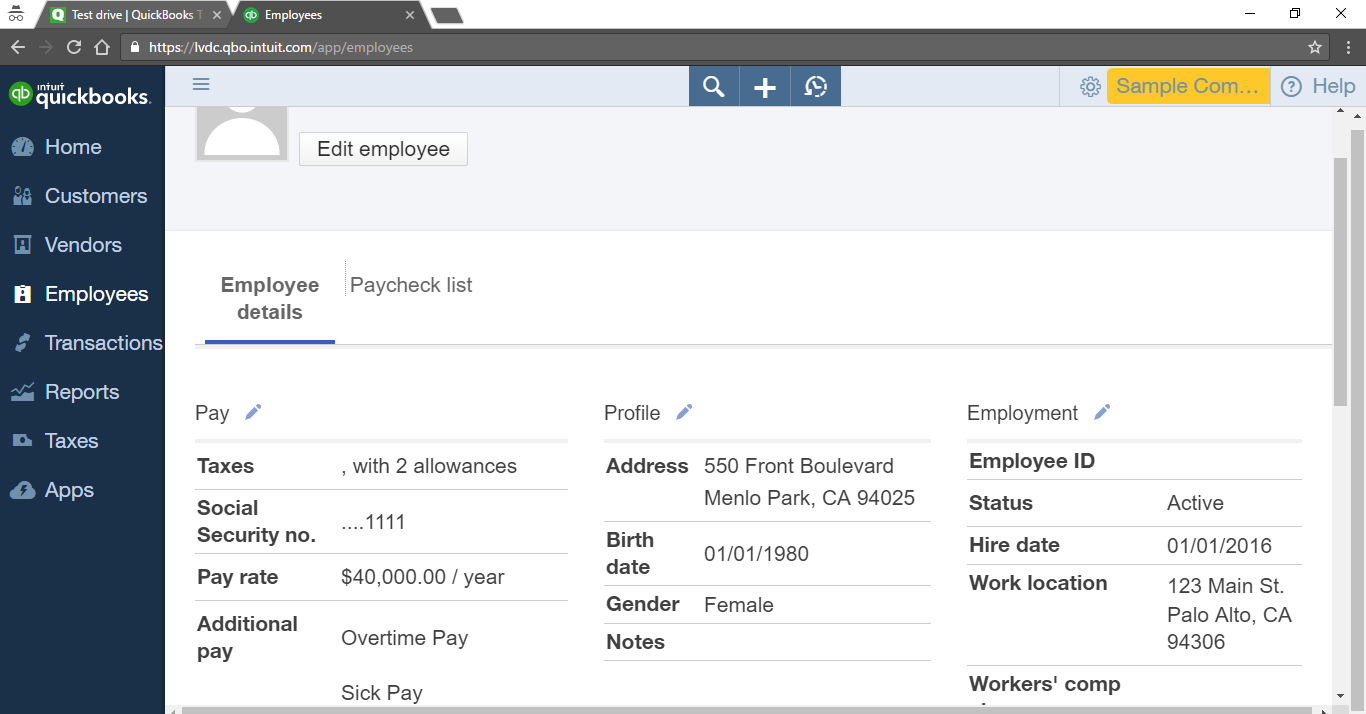

- Go to Employees Center.

- Select the name of the employee from the Employee list.

- Under Employee details, click “Pay” the pencil icon.

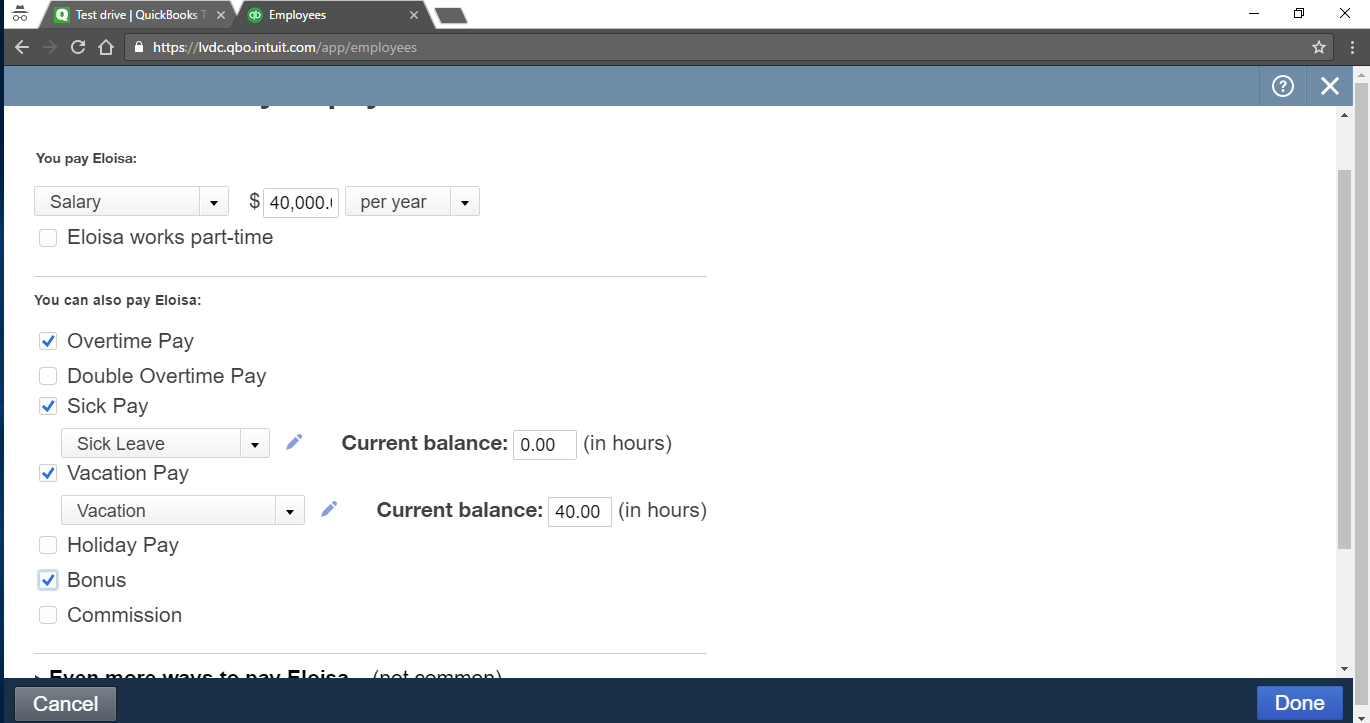

- Under question number three, click “Pay” the pencil icon again.

- Check the “Bonus” box.

- Click Done.

- Click Done.

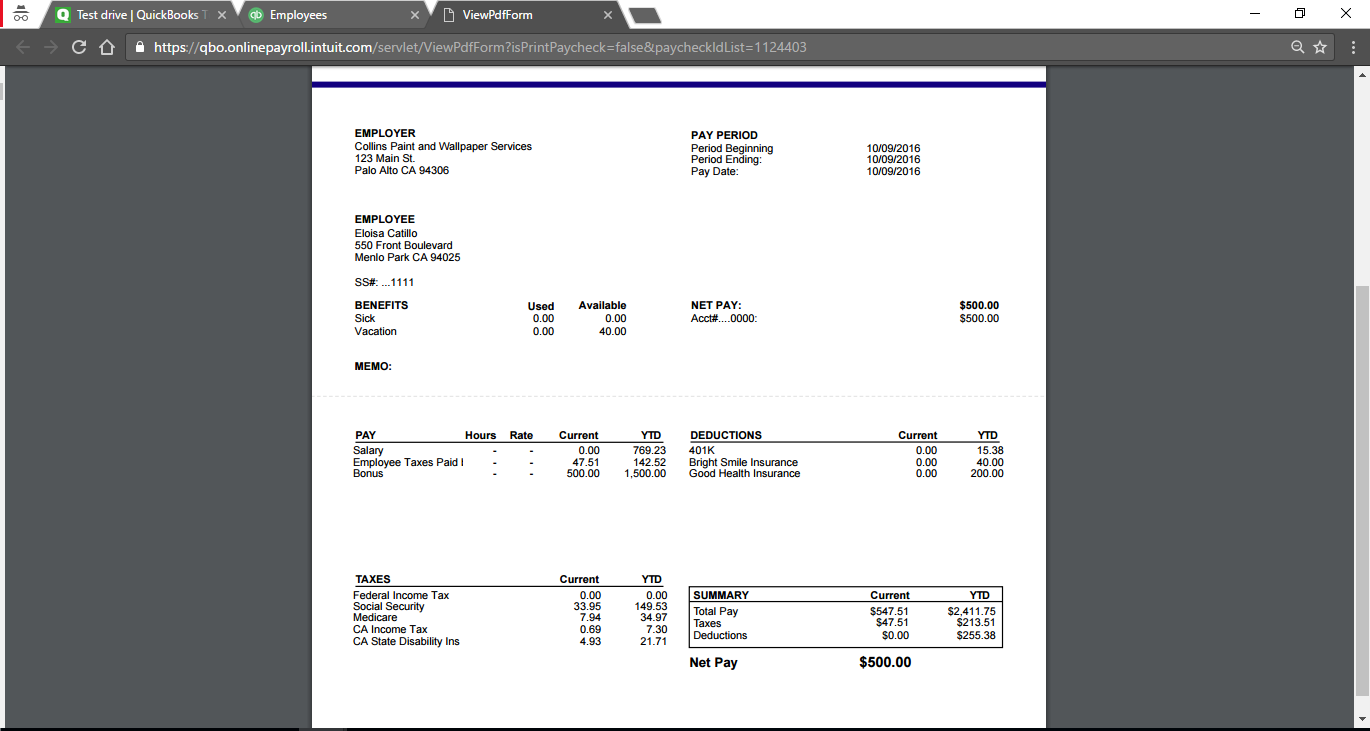

To run the Bonus check alone:

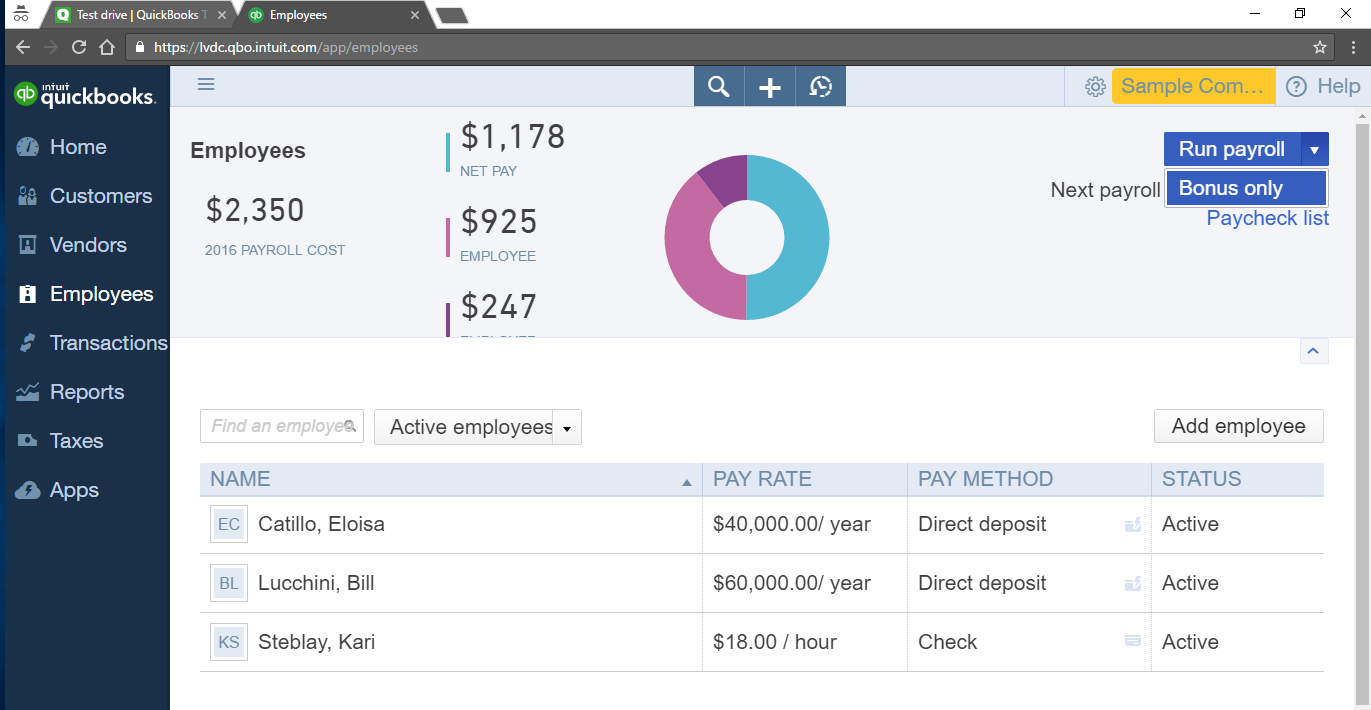

- Go to Employees Center.

- Next to the Run payroll button, click the drop-down arrow.

- Click Bonus only (at the upper right corner).

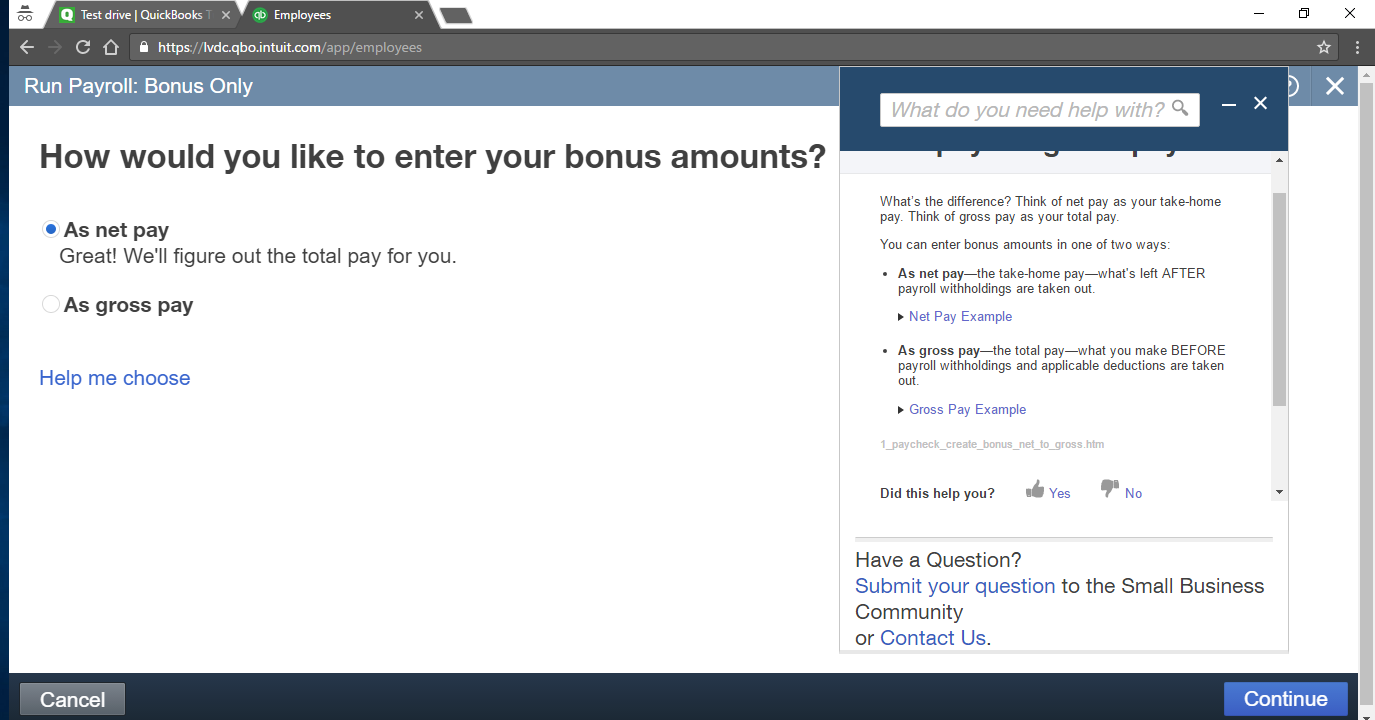

- Select As net pay or As gross pay.

- Click Continue.

- Enter the Pay date.

- Enter the Bonus amount.

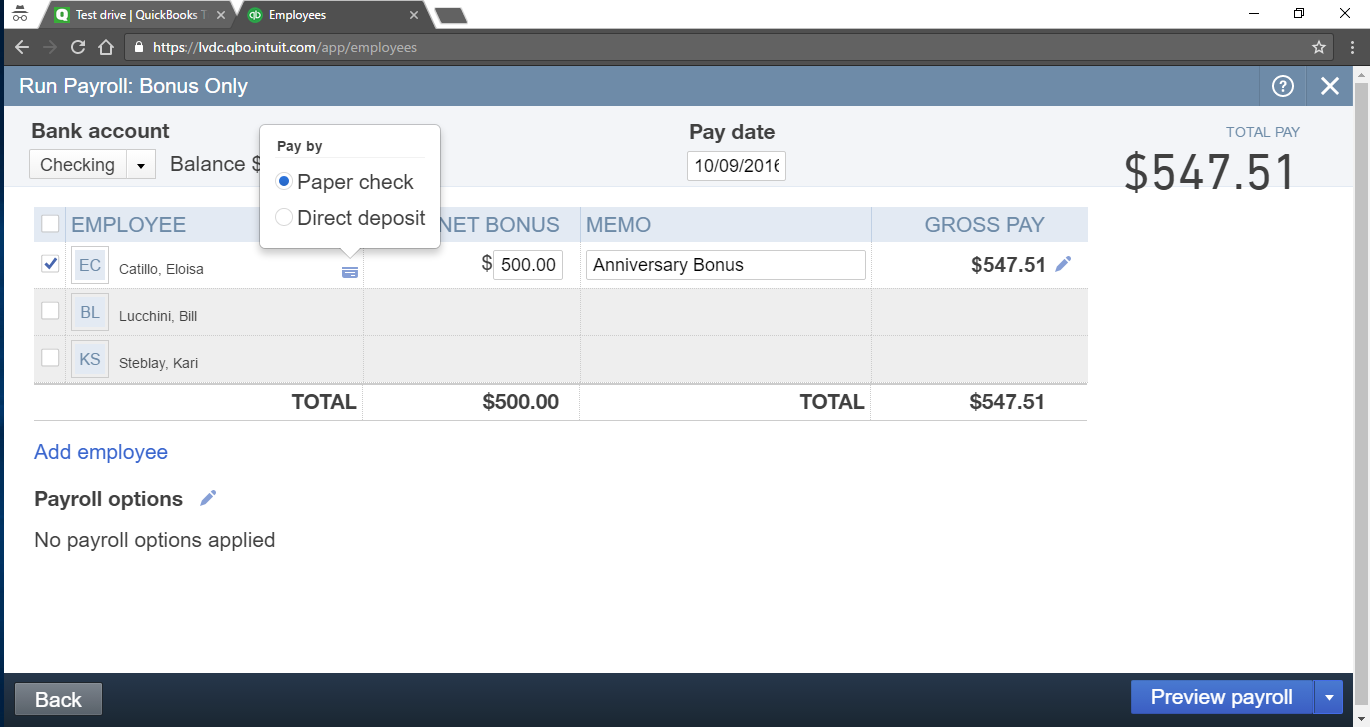

- To pay by paper check but not direct deposit, click the lightning icon, then switch “pay by” to paper check from direct deposit.

- Choose Bank account.

- Click Preview payroll.

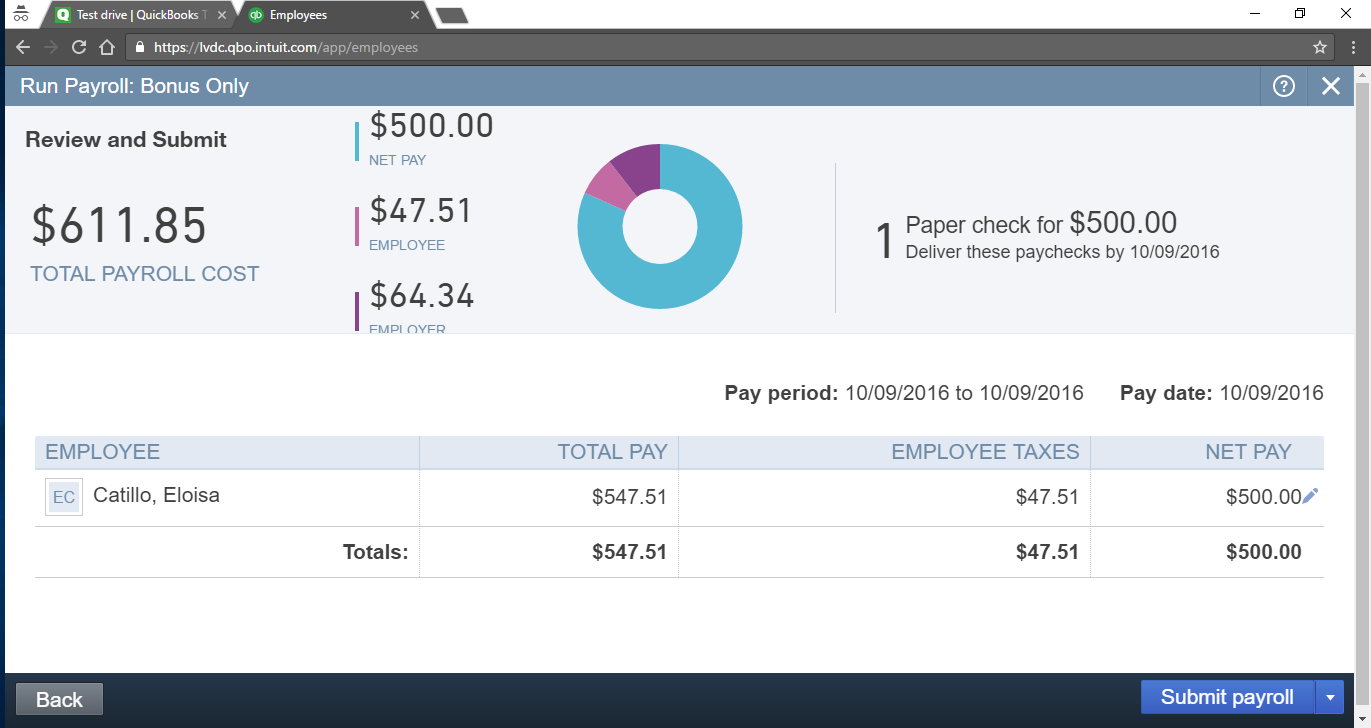

- It should also calculate employee taxes for that bonus amount.

- Click Submit payroll.

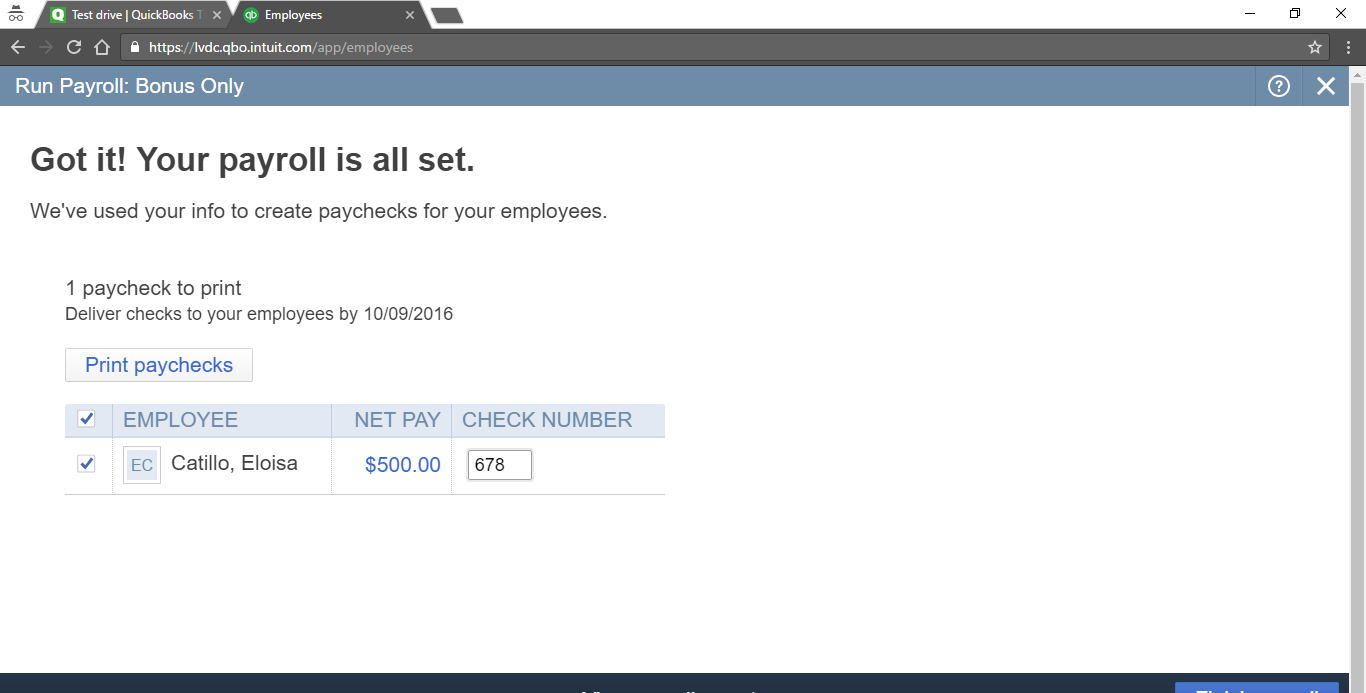

- Enter check number to print.

- Select Print paychecks button to print.

- Click Finish payroll.

To run the regular check with the Bonus amount:

- Under Employee, click the Run payroll button.

- Select the Pay Date and the Pay period.

- Enter the Bonus amount.

- Click the Preview payroll button.

- Click the Submit payroll button.

- Click the Finish payroll button.

[wpedon id=”7748″ align=”center”]

[wpedon id=”7748″ align=”center”]