This has to do with reflecting accurate direct expenses related to customers on Income by Customer Report.

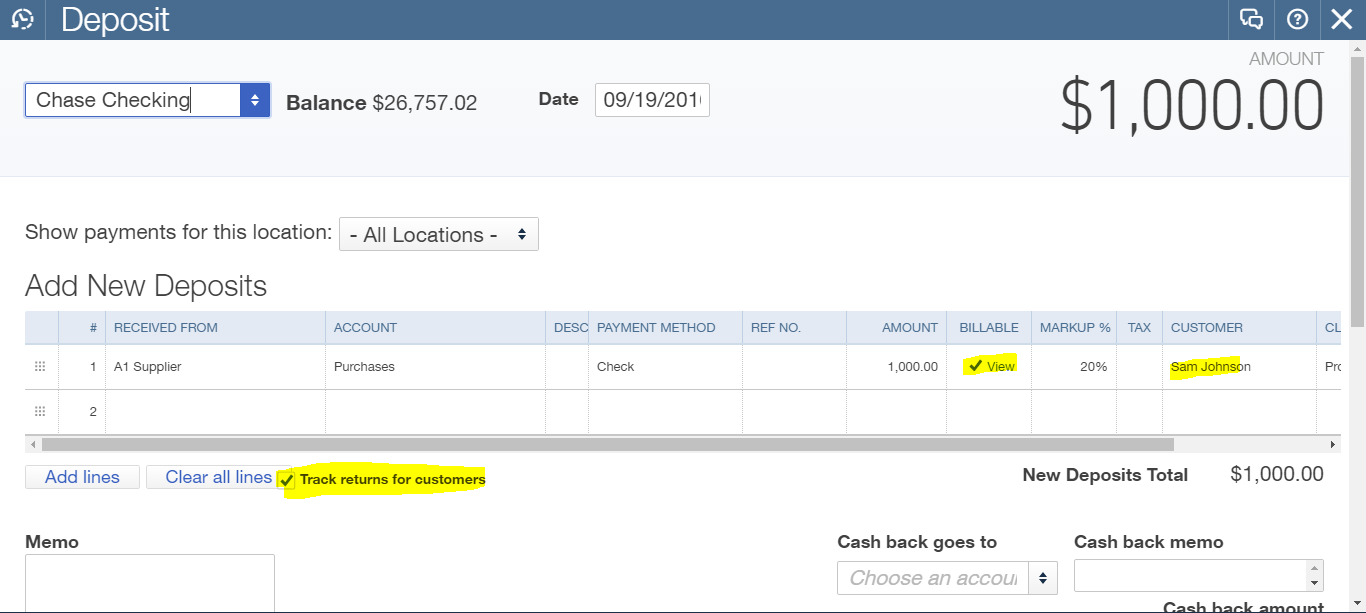

If you are depositing a vendor/supplier refund for an expense that was previously Billed to a customer, select “Track returns for customers” box and choose that same customer on the deposit and mark it Billable.

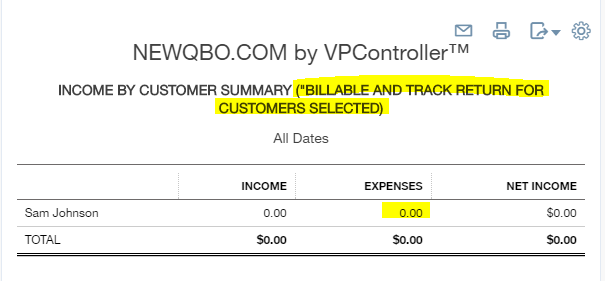

For example, if you buy a material for a customer’s job, you would bill the expense to the customer. But if the customer later returns the material to you and you return it to the vendor/supplier for a refund that you are depositing, you need to mark the deposit billable to that same customer and also select “Track returns for customers” box. Otherwise, it will show as customer billed for the material expense, and the vendor credit will not appear on Income by Customer Summary Report.

[wpedon id=”7748″ align=”center”]

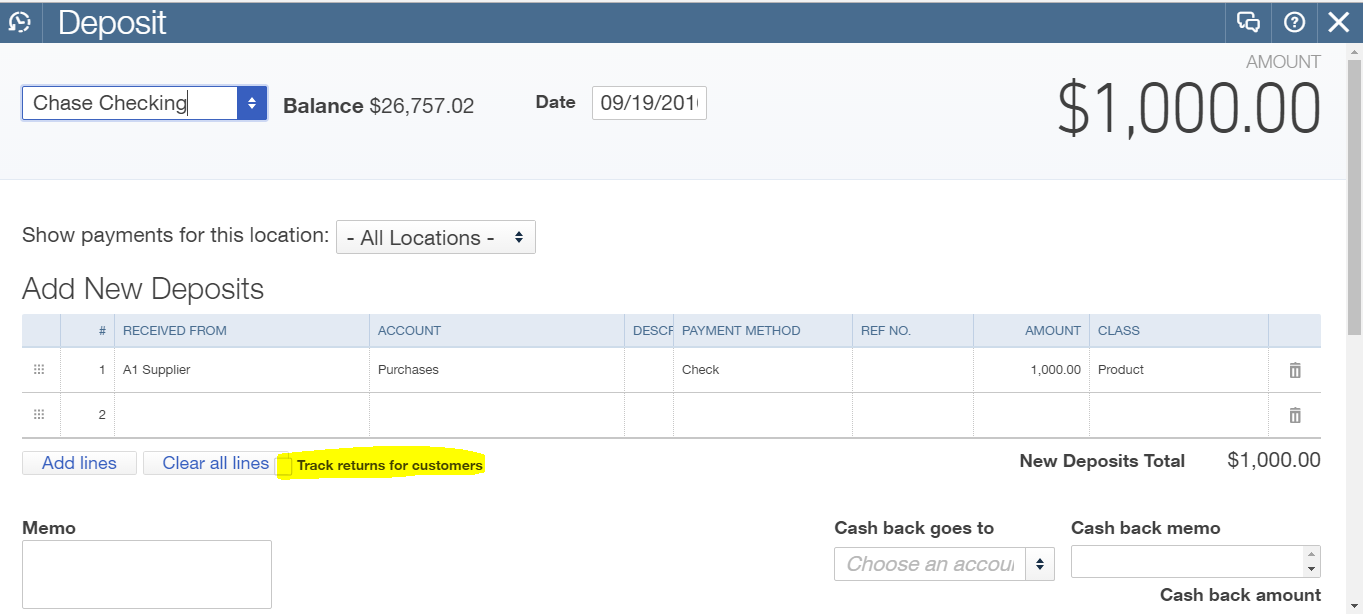

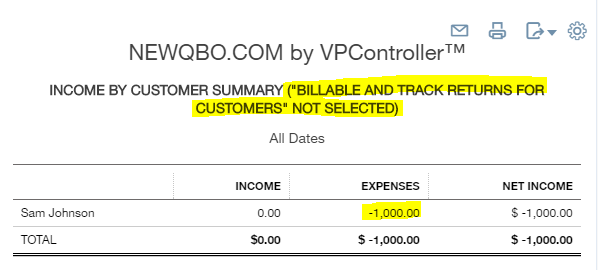

Here is an example of what happens when $1,000 billable purchase returned to the supplier for a refund and deposited that money in the bank. The goal is to show zero expense related to that customer.

SHOWING RESULT WITHOUT BILLABLE AND RETURNS FROM CUSTOMERS

SHOWING RESULT WITH BILLABLE AND RETURNS FROM CUSTOMERS

WATCH VIDEO

QuickBooks Online Plus: Track returns for customers box on Deposit Form

[wpedon id=”7748″ align=”center”]