It requires that R&D generally be expensed as incurred now.

So, in QBO, it should be considered an Overhead Expense, not a Direct Cost or COGS.

How to set up R&D as Overhead (O/H) in QuickBooks Online?

Figure out the main primary operating costs for R&D and categorize expense types.

In the QBO Chart of Accounts detail types are already defined. I would select “Other miscellaneous service cost” as a detail type to track costs related to R and D.

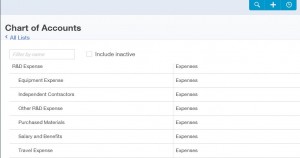

For example, your Chart of Accounts should be like this:

R&D Expense:

- Salary and Benefits

- Purchased Materials

- Independent Contractors

- Equipment Expense

- Travel Expense

- Other R&D Expense

This is just an example. Only your CPA can give you better guidance for your business.

QuickBooks Online Tutorial Videos