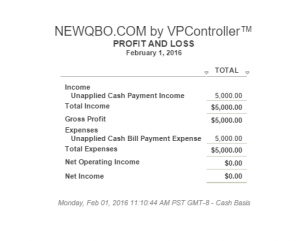

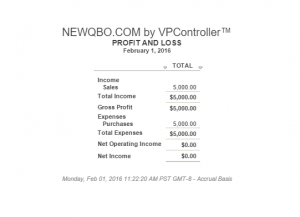

You may see two accounts for UNAPPLIED cash payments if you report Profit and Loss on a cash basis. It will automatically trigger these two accounts simply because you have entered certain deposit and payment transactions differently than normal flow in QBO.

These two accounts are automatically added to the Chart of Accounts when the new company file is created. You can’t delete or change these two accounts.

Here is the main reason that will trigger these two account types in QBO:

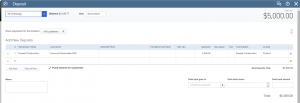

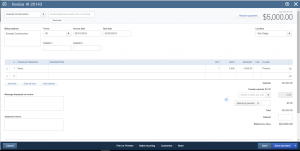

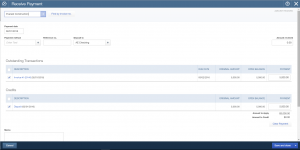

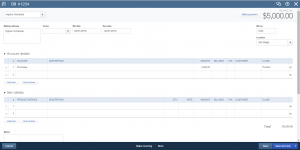

- Triggers “Unapplied Cash Payment Income” when the date of the customer deposit date is before the invoice date it’s applied to.

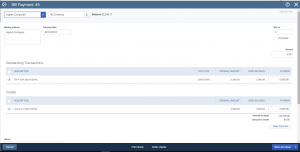

- Triggers “Unapplied Cash Bill Payment Expense” when the date of the vendor payment date is before the bill date it’s applied to.

Example of “Unapplied” Customer Deposit and Vendor Payment transactions

Changing “Invoice” and “Bill” dates to be before payment dates should work for most transactions in this account. However, there may be other unknown circumstances where the issue may not be easily fixed. In that case, you will need to analyze each transaction and resolve the matter. Or get help from an expert.

This video will show how to fix “Unapplied Cash Payment Income” and “Unapplied Cash Bill Payment Expense” on a cash basis Profit and Loss report.

OTHER HELPFUL LINKS:

(Also, refer to IRS Publication 538 Constructive Receipt of Income for more details.)

https://www.irs.gov/publications/p334/ch02.html

What’s Unapplied Cash Payment?

https://community.intuit.com/articles/1146009-what-s-unapplied-cash-payment

| If you found our answers useful then please contribute a few bucks to support this forum. Thank you! |