You have two ways of recording the transactions depending on the type of supplier pre-payment. Is it a quick turn around or will it take a longer time to complete the job or service?

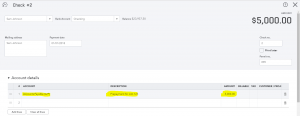

1) When you make vendor pre-payment, use Accounts Payable (A/P) under the Account tab. When the supplier bills you, create a Vendor Bill in QBO and use an appropriate account. That will clear the vendor’s pre-payment balance. This is the easy way to enter the transactions especially say if you can record both entries within less than a month. You will then need to match pre-payment and entered Bill to clear the account by clicking the Pay Bills tab (Create + sign > Vendors > Pay Bills).

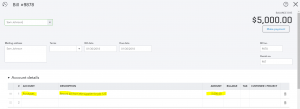

2) You may use this method if pre-payment to the supplier will take longer than 30 days to clear. In order words, for example, you make a pre-payment job in January and the job will not be complete until June.

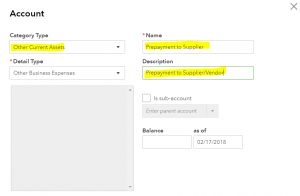

To set up pre-payment to the supplier, create a new account. You would set up “Pre-Payment to Supplier” as other current assets in QBO

SETUP PREPAYMENT SUPPLIER ACCOUNT

When you receive a Bill, enter the expense account to be charged. On the next line, select Pre-Payment to Supplier account and enter it as a negative amount. If the received bill is the same as pre-payment then, it will net out as zero entry. But if the actual bill says higher than the pre-payment amount then, you just make the payment for the difference. That will clear the account.

ENTER BILL AND CLEAR THE PREPAYMENT ACCOUNT

QuickBooks Online Tutorial Videos