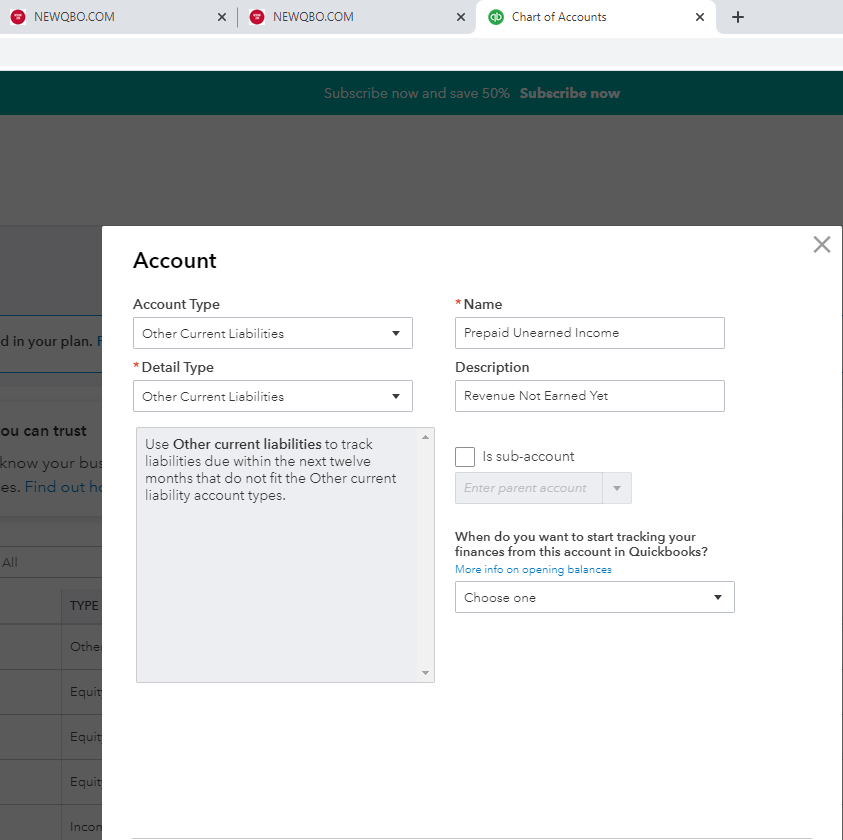

As a general accounting method (especially if you’re an Accrual basis)*, you would record Prepaid Unearned Income from Customer to a Current Liability account. See the screenshot below for how to create this account in your Chart of accounts.

You’ve two ways of handling this, select one which works best for your business.

Option 1:

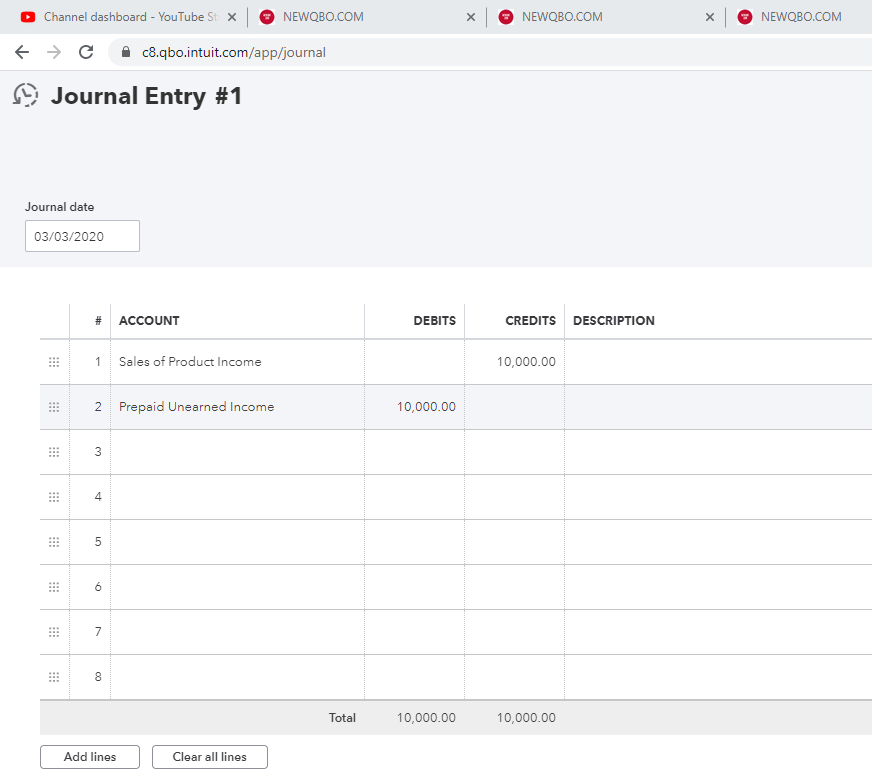

If you’re depositing this money in (and not creating Invoice), deposit to this account. And when ready to recognize income, write a Journal Entry (credit Income/Revenue account and debit Prepaid Unearned Income account).

Option 2:

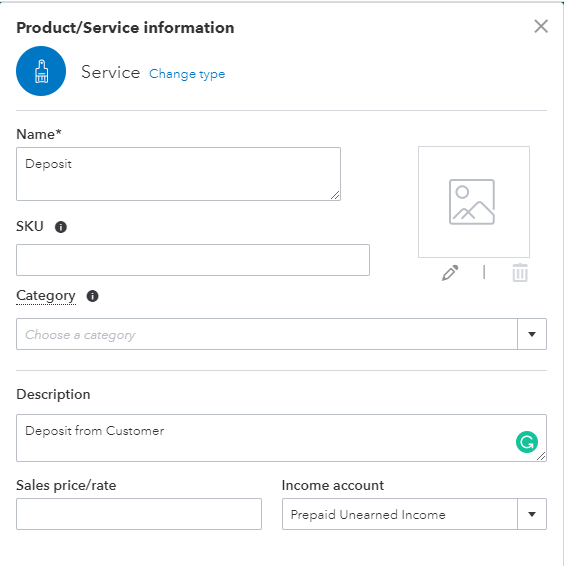

If you’re creating an Invoice for this money in, you will need to add a new Product/Service item for this prepaid unearned income item. For the Income account field on the Product/Service information screen, you would select this Prepaid Unearned Income account. Create an Invoice using this item once to record prepaid deposit and create a 2nd Zero Invoice when ready to recognize Income (positive item) and clear Prepaid Unearned Income (negative item).

* If you’re on Cash basis accounting method, consult with your Accountant.