In an ideal accounting process, I would think handling discounts taken by the customer would be part of the “Receive Payment” form screen. They will have the additional line to enter discounts given to the customer as negative amount entered and thereby would match customer payment amount.

Since the QBO Receive Payment screen is unable to handle this specific transaction, you will need a way-around approach. No doubt, it is unnecessary and time-consuming steps to handle such a simple customer payment transaction.

You will need to create a CREDIT MEMO for the early discount taken by the customer. See photo#3 for reference.

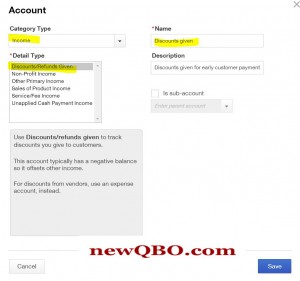

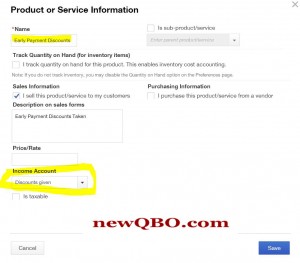

For one-time, you will also need to create a new GL account for “Discounts are given” (see photo 1) and a new Service item for “Early Payment Discounts” (see photo 2).

Once you’ve created a Credit Memo, go to Receive Payment screen, apply for payment against the open invoice as well as apply to subtract early payment discounts to match customer payment. See photo#4 for reference.

See screenshot photo#5 for reference to how it will show Discounts given in P&L.

See screenshot photo#5 for reference to how it will show Discounts given in P&L.

http://feedback.qbo.intuit.com/

Photo#1

Photo#2

Photo#3

Photo#4

Photo#5

| If you found our answers useful then please contribute a few bucks to support this forum. Thank you! |