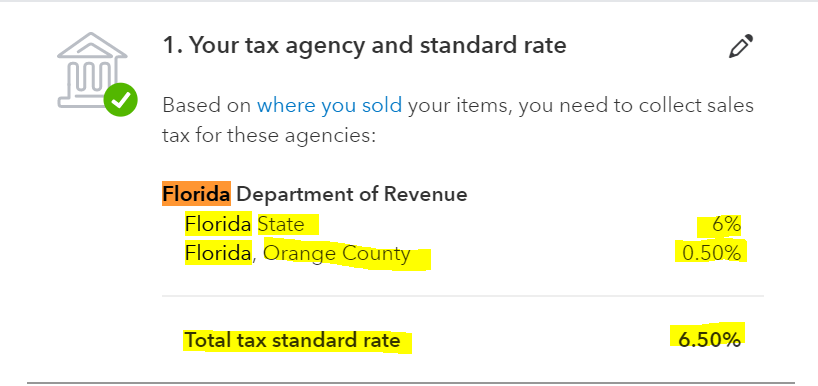

In many states, they also have additional taxes for local in addition to state sales tax. Example: How to properly create Invoice to calculate a 6.5% sales tax in Florida, Orange County. (6% State and 0.5% City).

The new automated QBO sales tax feature can be accurate if you following the following steps:

- It’s best to use the full USPS verified Zip+4 digits code (represents a specific delivery route within that overall delivery area). This will help QBO get the exact location for appropriate local city taxes.

- When you set up the sales tax in QBO (left Dashboard > Taxes > Sales Tax Settings), click the drop-down menu and scroll down to State. Select the city if listed separately. If City is not separately, select the State, that should calculate local taxes correctly. It’s best to use the full USPS verified Zip+4 digits code (represents a specific delivery route within that overall delivery area). This will help QBO get the exact location for appropriate local city taxes.