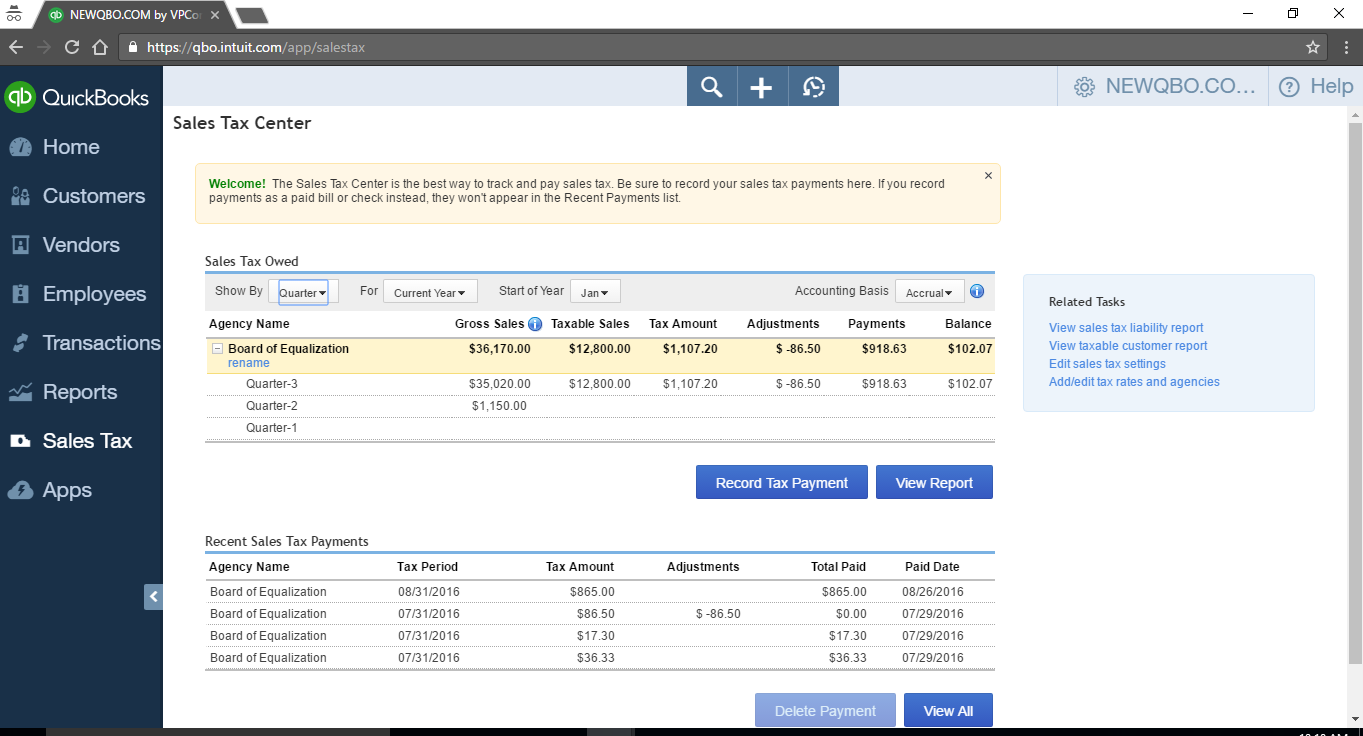

The Sales Tax Center (From the Homepage screen > Left navigation bar > Sales tax) is where to set up and track sales tax for your company in QuickBooks. This is the best way to track, pay sales tax and review sales tax reports in one place.

In Sales Tax Center, you can:

- Set up sales tax (both single and up to 5 combined rates) so you can charge sales tax on invoices and sales receipts

- See sales tax owed

- See sales tax collected from customers

- Record ALL your sales tax payments here (note: do not use a paid bill or check or expense to record tax payment. They will need not appear in the Sales Tax Center.)

- View gross sales and taxable sales report

- See recent sales tax payments

- Set a default tax rate for your company

- Mark customers as taxable or tax-exempt

The other main tasks you do with sales tax center are:

- View sales tax liability report

- View taxable customer report

- Edit sales tax settings

- Add new, edit and delete tax rates and agencies in the Sales Tax Center

How to Manage SALES TAX – set up, collect, report and pay sales tax

See also

HOW TO SET UP SALES TAX FOR VARIOUS TAX AGENCIES BUT MAKE PAYMENT ALL ON ONE CHECK

DO WE CHARGE SALES TAX ON A DISCOUNT AMOUNT

HOW TO PRINT SALES TAX CHECK IN NEW QUICKBOOKS ONLINE?

WHERE DO I FIND THE AMOUNT OF SALES TAXES DUE IN NEW QUICKBOOKS ONLINE?

HOW DO YOU DELETE/DEACTIVATE A SALES TAX CODE IN NEW QUICKBOOKS ONLINE?

DO YOU HAVE TO SEPARATE THE SALES TAX PAID TO A VENDOR WHEN RECORDING IN QUICKBOOKS ONLINE?