Let’s get started. Follow the step-by-step instructions.

Example: A vendor/subcontractor perform work on our behalf, we deduct 20% of the bill amount as Retention when we pay them. This is to protect us from any potential liability out of their faulty work. How do I record it in Quickbooks?

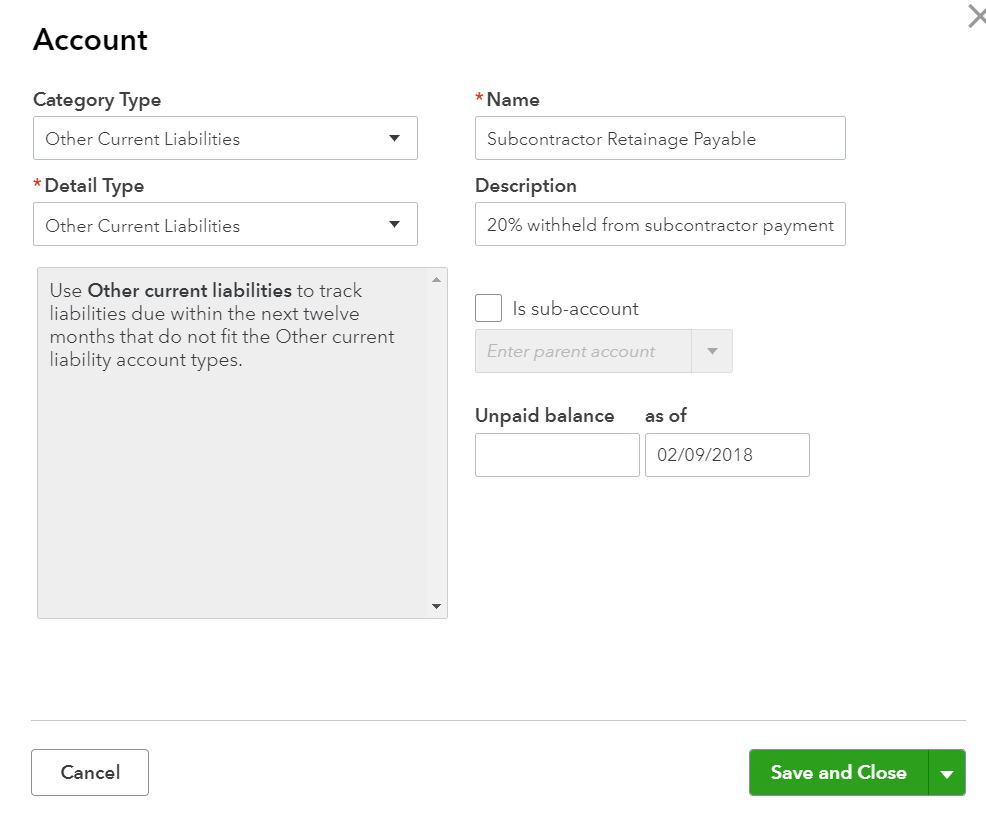

1. To set up sub-contractor retainage tracking, create a new Retainage account in the Chart of Accounts:

- From the left Dashboard panel, click Accounting.

- In the Chart of Accounts, click “New” green button at the far top right corner.

- For Category Type, select Other Current Liabilities.

- For Detail Type, select also Other Current Liabilities.

- For the Name, enter Subcontractor Retainage Payable.

- For the description, enter same as Name or something like 20% withheld from subcontractor payments.

- Click Save and close.

See screenshot below for reference.

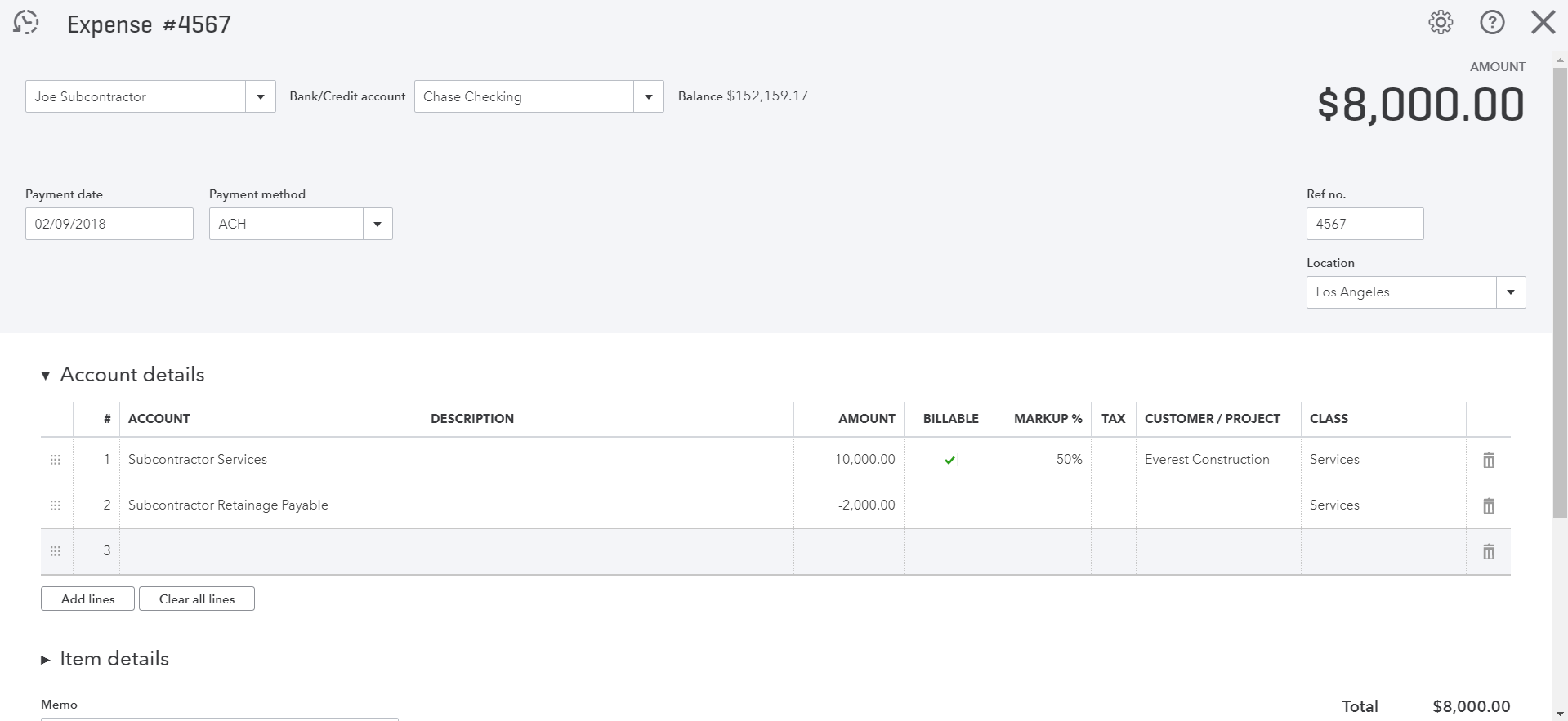

2. To enter expense bill and withheld retainage from a Subcontractor Bill:

In this example: Subcontractor bill is $10,000; pay them $8,000 and retain $2,000 for 4 months.

- Click the + plus symbol, located at the top of the screen.

- Select Expenses, Check or Bill under Vendors heading.

- Select your subcontractor as a vendor.

- Fill out the remaining fields of the vendor invoice.

- Select COGS or expense account under Account tab. (line 1, amount = $10,000).

- Line2, select Subcontractor Retainage Payable account, enter negative amount (example = -$2,000).

- The total amount should show $8,000.

- Click Save and close.

See screenshot below for reference.

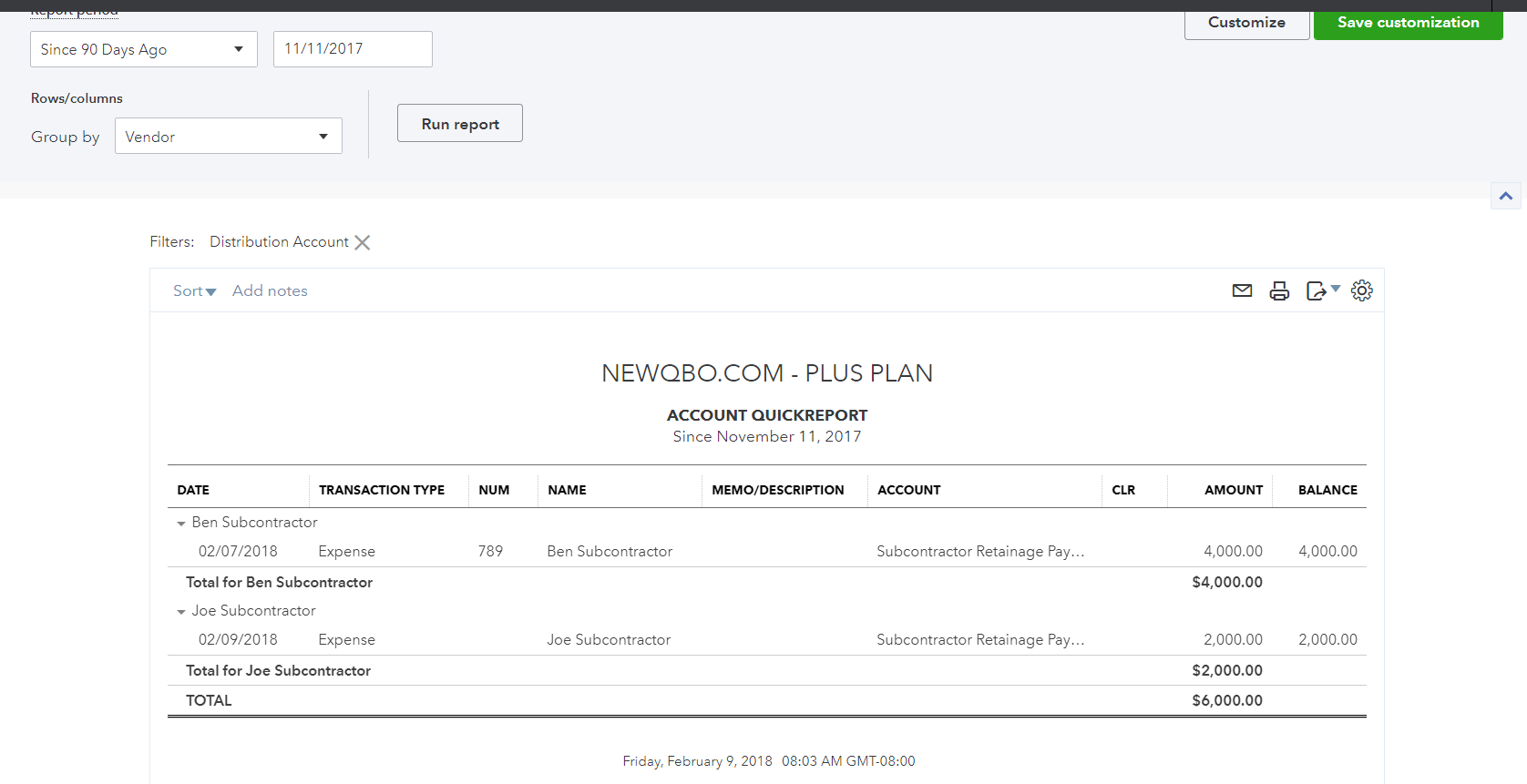

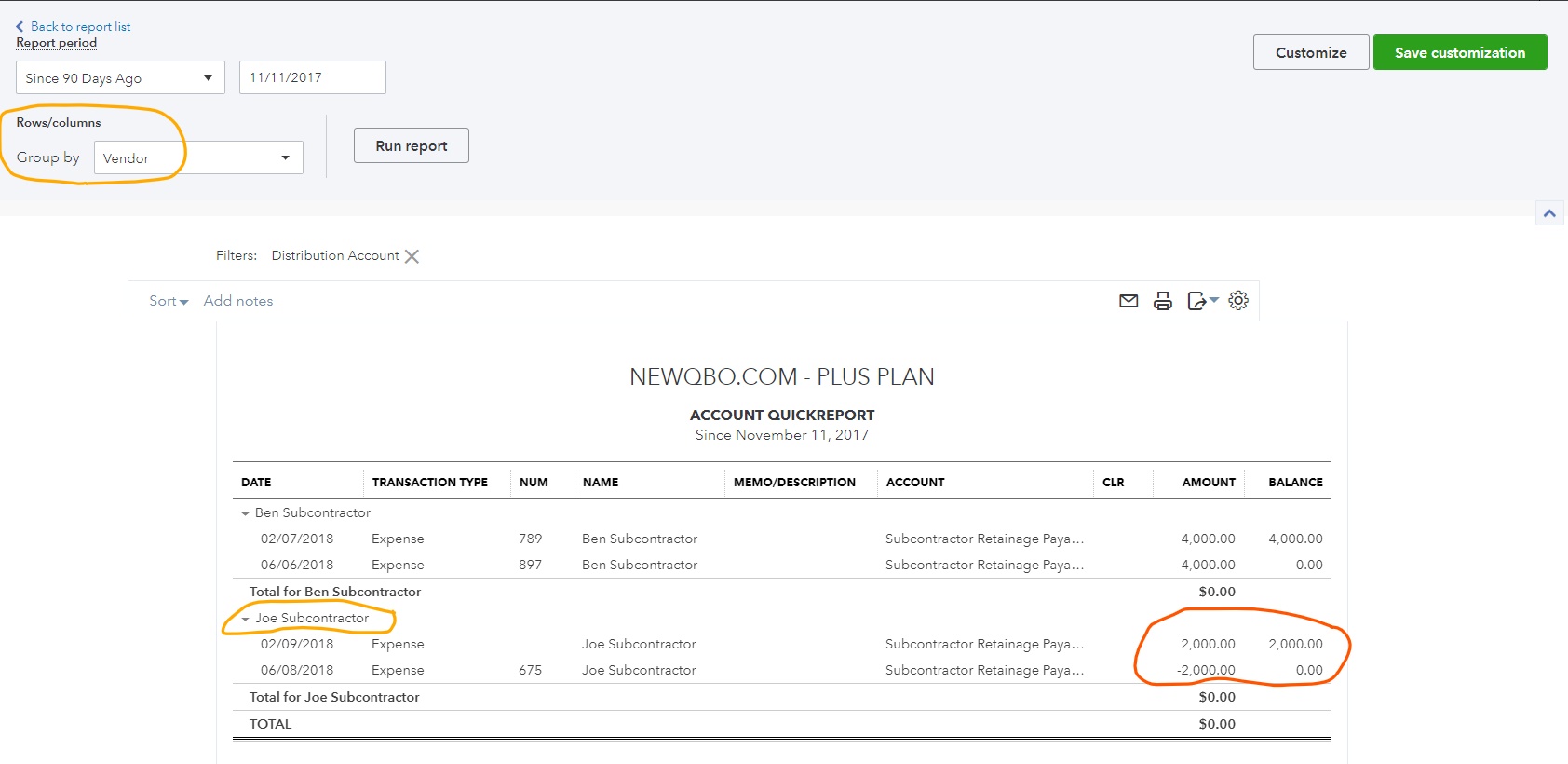

3. To run a Subcontractor Retainage Payable account report for various subcontractors:

- From the left Dashboard panel, click Accounting.

- In the Chart of Accounts, locate “Subcontractor Retainage Payable” account line.

- Go to “View register” under Action column at the far right corner.

- From the drop-down arrow, select the “Run Report” button.

- Row/Columns at the top left, change “Group by” to Vendor (especially if you have multiple vendors with retainage balances).

- Click Run Report.

- This report will give account details by vendor balances.

- Since you will need to track these retainage activities, click “Save customization” green button, located in the top-left corner of the report window and name it “Subcontractor Retainage” report and Save.

Now, you have saved this report for future use. - Next time, when you want to run this report (Dashboard > Reports > Custom Reports tab > locate Subcontractor Retainage report and run the report).

See screenshots below for reference.

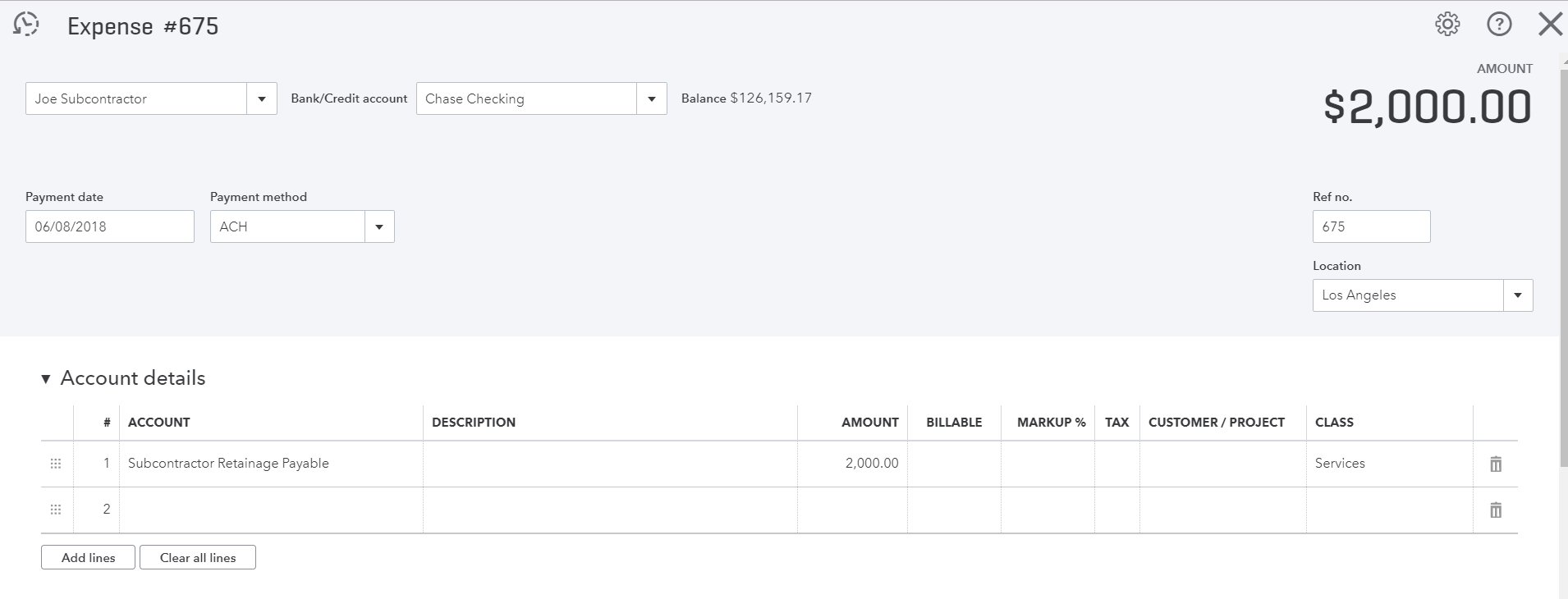

4. To make 20% Retainage balance payment:

- Same as to enter vendor expense bill as above (step #2).

- For an account, use Subcontractor Retainage Payable account. Example, $2,000. That will clear the account but do the account analysis on a regular basis.

See screenshots below for reference.

5. Run Report after 20% withheld paymentL

Follow step#3 above on how to run report.

See screenshots below for reference.

For “How to handle customer retainage retention in QBO” click HERE.

If you have questions regarding this article or any other QuickBooks issues, please CLICK HERE to ask a question.