-

- From the left Dashboard panel, click Accounting.

- In the Chart of Accounts, click the “New” green button at the far top right corner.

- For Category Type, select Other Current Assets.

- For Detail Type, select Retainage (at the near bottom).

- For the Name, enter Retainage Receivable.

- For the description, enter Retainage Receivable (same as Name).

- Click Save and close.

- See the screenshot below for reference.

Create a Retainage item from the Products/Services:

Create a Retainage item from the Products/Services:

- Click the gear in the top-right corner of the screen.

- From the drop-down menu, within the Lists section, select Products and Services.

- In the Products and Services window, click the “New” green button at the far top right corner.

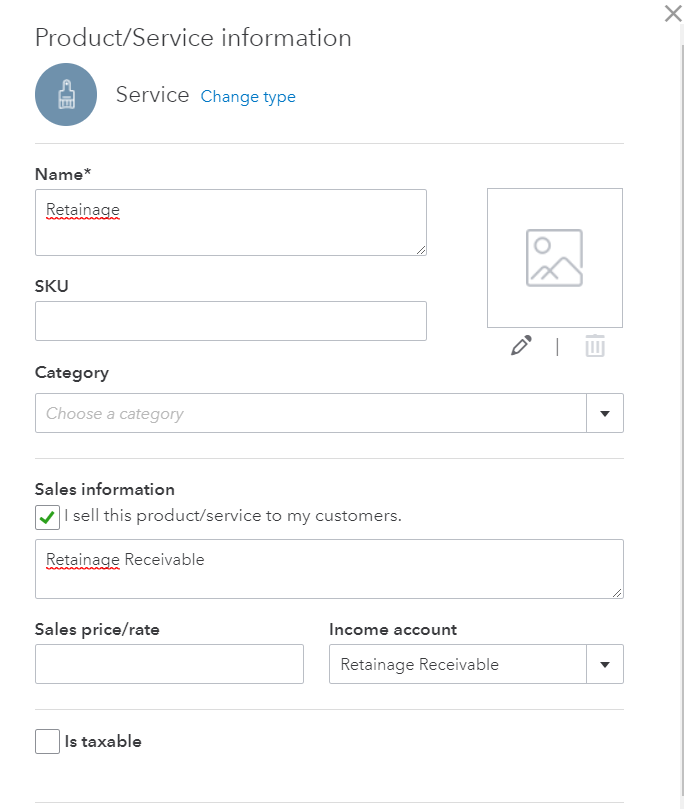

- Select “Service” under Product/Service information

- Enter a Name for the item (i.e. Retainage).

- Optional: SKU and Category fields.

- Under Sales Information, place a check-mark next to I sell this product/service to my customers and enter “Retainage Receivable” (this is for the description of sales forms i.e. Invoice).

- Select the Retainage Receivable account (you just created) from the Income Account drop-down.

- Be sure to Uncheck the “Is taxable” box.

- Click Save and close.

- See the screenshot below for reference.

How do I record retainage or retention in QBO continue… The next step is to create an invoice/sales receipt with a retainage withhold line item.

2) To withhold retainage from an invoice/sales receipt:

How do I record retainage or retention in QBO continue… The next step is to create an invoice/sales receipt with a retainage withhold line item.

2) To withhold retainage from an invoice/sales receipt:

- Click the + plus symbol, located at the top of the screen.

- Select Invoice under Customers heading.

- Select your customer.

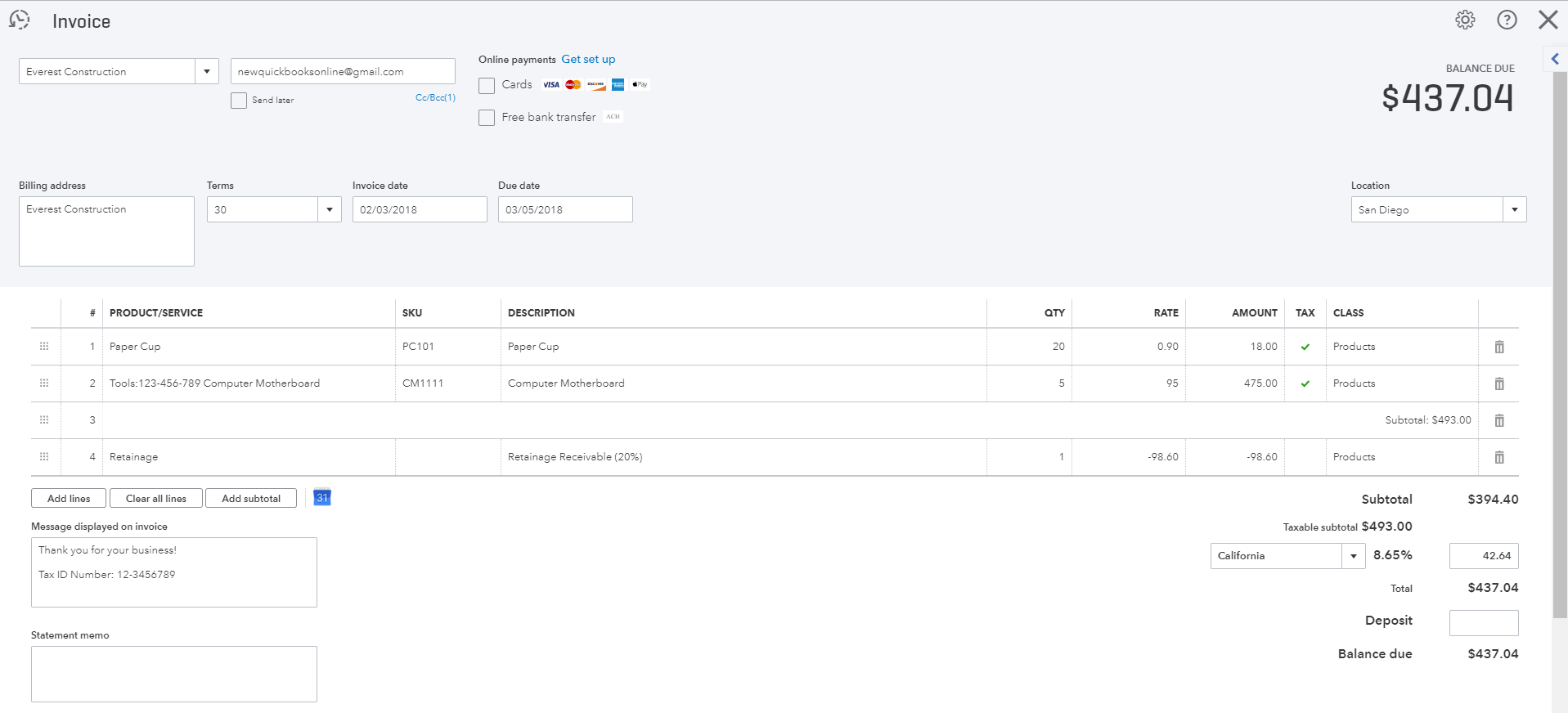

- Fill out the remaining fields of the invoice, including the product/service line items.

- Optional: if you’ve multiple line items, click “Add subtotal” (below Product/Service column).

- On the next available line of the invoice, select “Retainage” from the Product/Service column.

- In the Rate or Amount column, enter the amount of the retainage as a negative (-) number. (In this sample Invoice below, the subtotal line amount is $493.00 and 20% is retainage rate. So, either on rate or amount column, just enter 493*-.20 and tab it. You will get a negative $98.60 or just compute the amount and enter it).

- Click Save and close.

- See the screenshot below for reference.

3) To record Received Retainage Refund Payment Deposit:

3) To record Received Retainage Refund Payment Deposit:

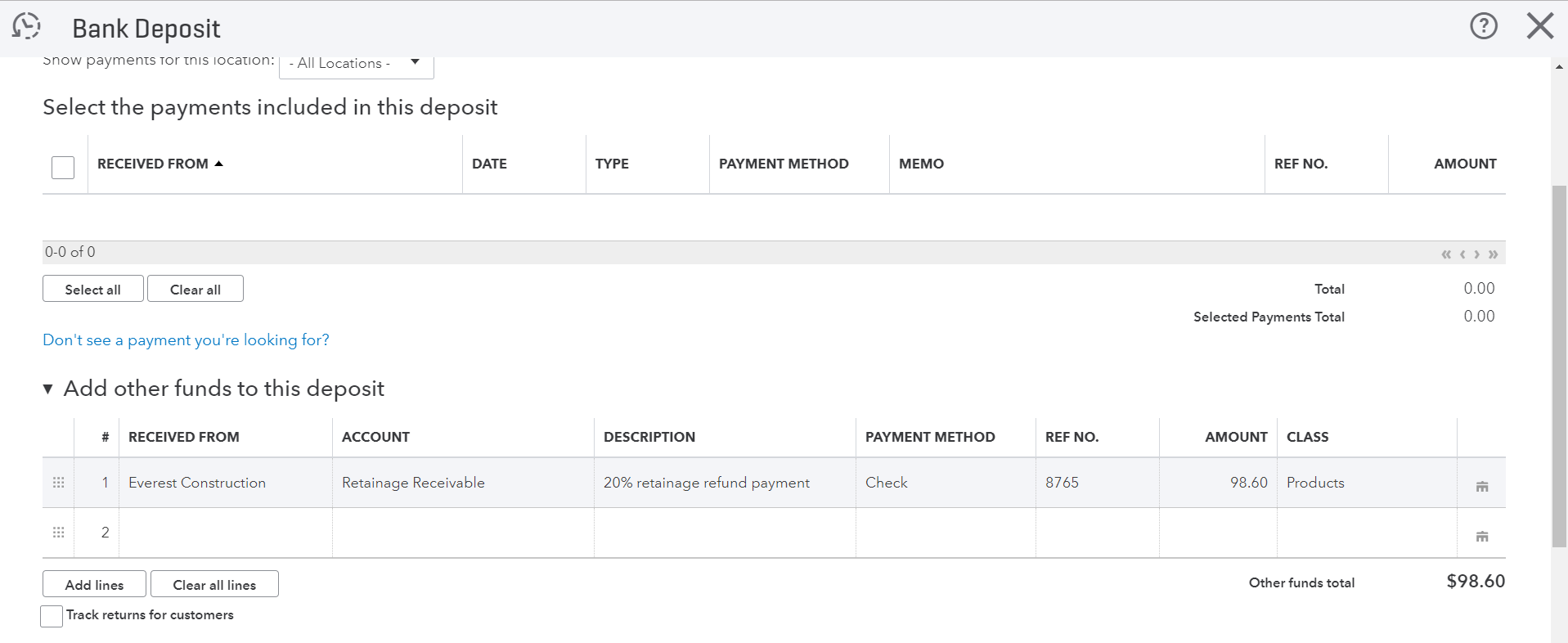

- Click the + plus symbol, located at the top of the screen.

- Select Bank Deposit under Others heading.

- Go to “Add other funds to this deposit” section

- Fill out Received From = Your Customer’s Name Account = Retainage Receivable And enter the rest as you need.

- Save and close.

- See the screenshot below for reference.

4) To run a report on Retainage Receivable accounts from various customers:

4) To run a report on Retainage Receivable accounts from various customers:

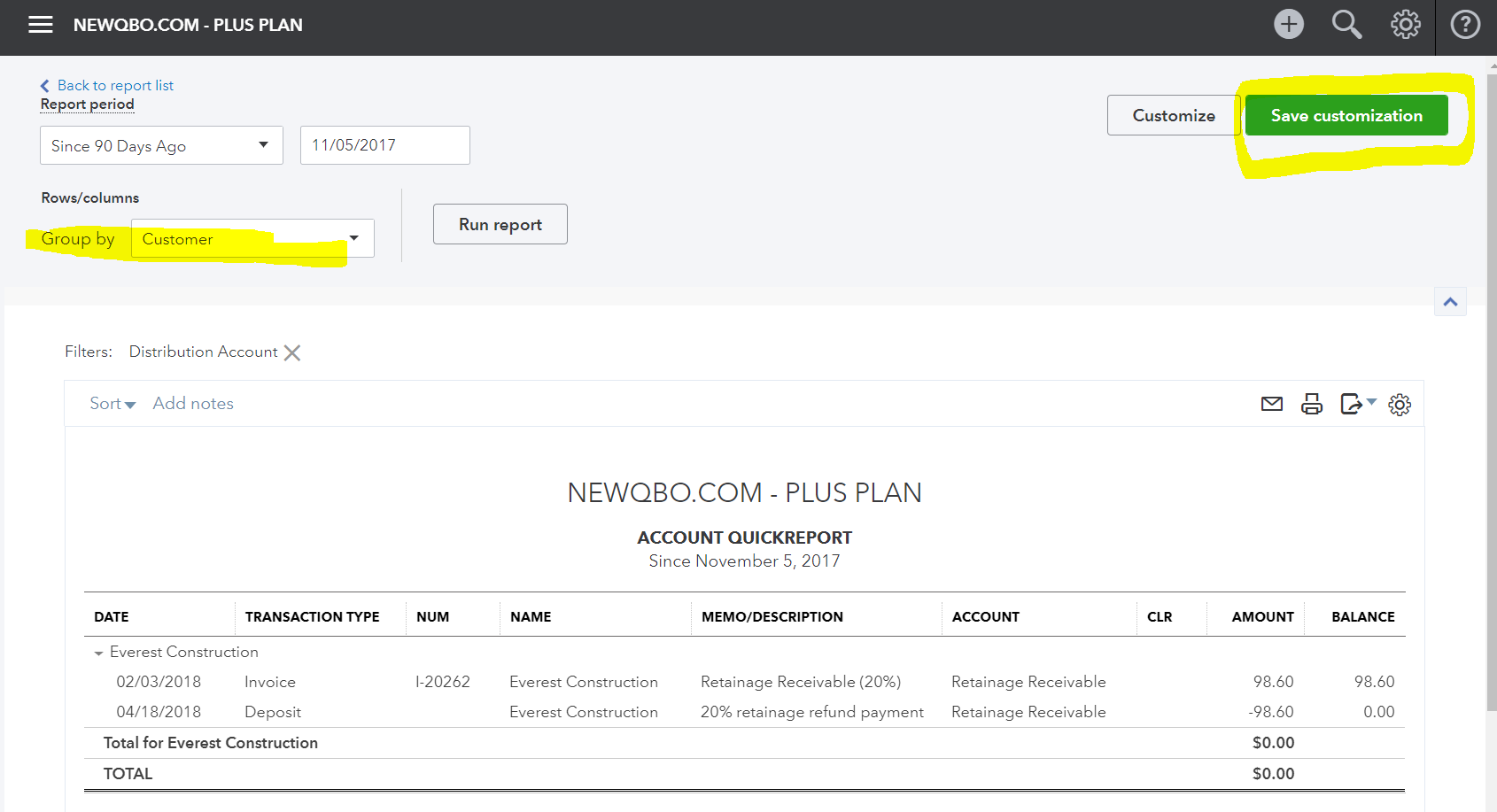

- From the left Dashboard panel, click Accounting.

- In the Chart of Accounts, locate the “Retainage Receivable” account line.

- Go to “View register” under the Action column at the far right corner.

- From the drop-down arrow, select the “Run Report” button.

- Under Row/Columns at the top left, change “Group by” to Customer (especially if you have multiple customers with retainage balances).

- Click Run Report. This report will give account details by customer balances.

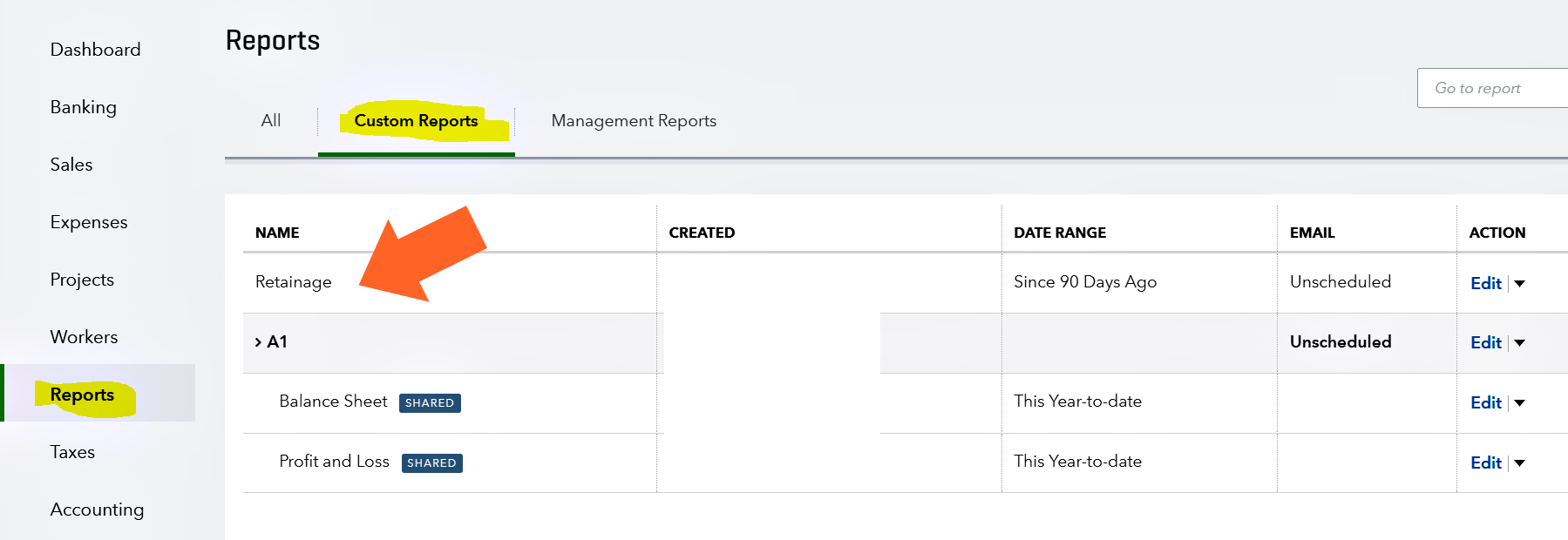

- Since you will need to track these retainage activities regularly, click the “Save customization” green button, located in the top-left corner of the report window, and name it “Retainage” report and Save.

- Now, you have saved this report for future use. Next time, when you want to run this report (Dashboard > Reports > Custom Reports tab > locate Retainage report and run the report).

- See the screenshots below for reference.

If you found our answers useful then please contribute a few bucks to support this forum. Thank you!

[wpedon id=7748]

For “How to handle vendor subcontractor retainage retention in QuickBooks Online” Click HERE. If you have questions regarding this article or any other QuickBooks issues, please CLICK HERE to ask a question.

How to handle customer retainage retention in QBO

How to handle customer retainage retention in QuickBooks Online?

Example: A customer we do work for keeps 20% of our invoiced amount until we reach a certain amount. That money is ours. They just hold it back in an account for us in case something goes wrong on a job that is our fault. How do I record that in QBO?

DEFINITION: Retainage is a portion of the agreed-upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project.

Let’s get started with step-by-step instructions for you.

1) To set up retainage tracking in the Chart of Accounts and Products/Services:

Create a new Retainage account in the Chart of Accounts: