If it’s fully-owned that means you should not have liability balance in your QuickBooks. But what about the asset value and accumulated depreciation?

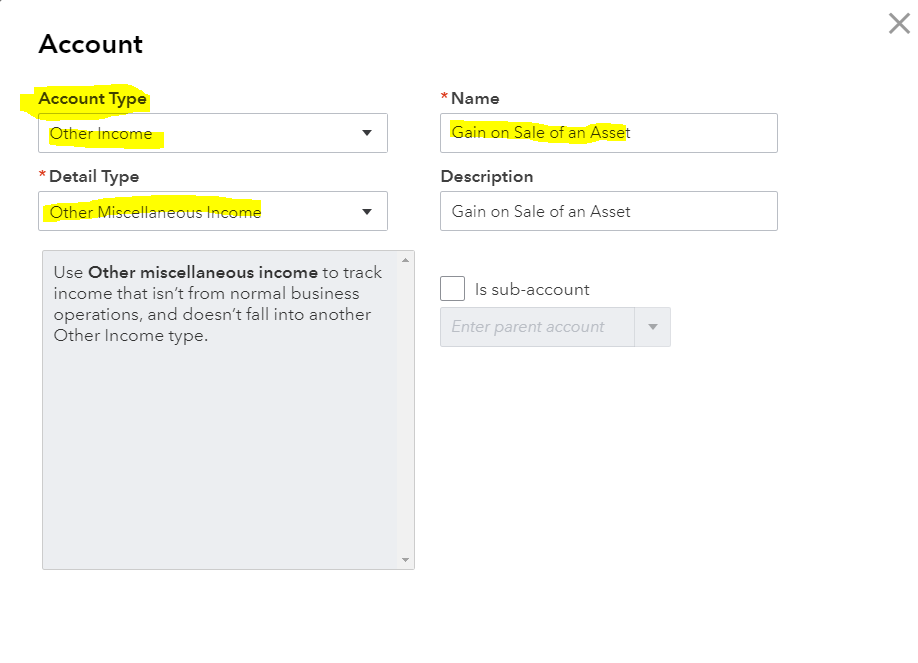

You will need to remove the asset and accumulated depreciation from the books and also figure out the Gain or Loss on Sale of an Asset. See the screenshot below on how to set up this account.

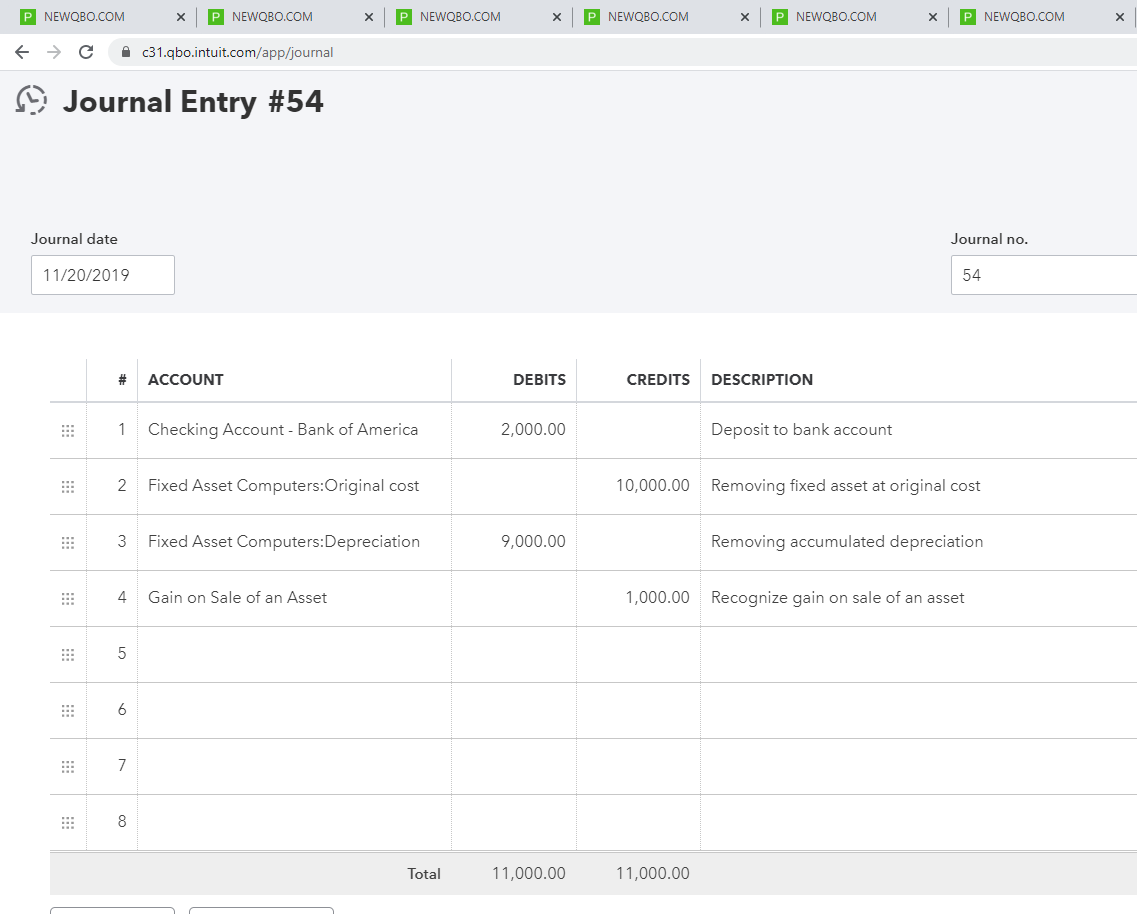

You can write a Journal Entry in QBO to record this transaction.

For Example:

Let’s say you sold the vehicle for $2,000

The original Cost is $10,000.

Accumulated Depreciation is $9,000.

Gain on Sale of an Asset is $1,000. (Gain is credit. Loss is debit)

Your Journal Entry will look like this…see the screenshot below for reference.

Also, make sure depreciation expense is up-to-date. That will change the accumulated depreciation amount if it’s current.